Secret takeaways

- There are lots of differences between HELOCs, signature loans and you will handmade cards.

- HELOCs was indeed wearing within the dominance given that home values enjoys grown.

- Evaluating advantages and you can disadvantages of money helps you determine the best choice.

You may be about to carry on a home renovation, buy knowledge, otherwise make your home eco-amicable which have solar panel systems otherwise finest insulation. Whenever capital is needed, it assists doing an abdomen-examine as to and that choice is right for your unique situation. However with unnecessary selection on the market, how will you discover that is most effective for you? Why don’t we acquire some clearness of the looking at three head investment source: HELOCs (home collateral credit lines), signature loans and installment loan agency Jacksonville VT credit cards. Just after doing some browse, it is possible to we hope be well informed around your choice.

Do you know the chief differences when considering a great HELOC, personal bank loan and you may credit cards?

Some fundamental differences when considering a home security personal line of credit, an unsecured loan and you can a credit card is interest levels, fees words, charge and financing wide variety. It helps to help you map out brand new blueprint of one’s precise words into the for every single possibilities when designing behavior that may connect with coming specifications. Here is how the three sorts of resource break apart:

HELOC: A HELOC try a personal line of credit where you borrow funds contrary to the equity of your house. You may have read the rise in popularity of HELOCs could have been ascending including home values. Yet another identity to possess an effective HELOC are another home loan, and this fundamentally towns and cities a good lien on your home. A standard guideline based on how far guarantee is needed to obtain a great HELOC, it’s 20%, although some associations disagree on that shape. HELOCs constantly incorporate all the way down APRs (annual fee prices) than just playing cards otherwise unsecured loans, but there is certainly annual charge inside it. So you’re able to estimate just how much equity you really have in your home, you simply make the difference between the worth of your home and you can that which you still are obligated to pay on your own mortgage. Once you have calculated an entire number of security, your ount. The borrowed funds-to-worthy of (LTV) ratio can be your newest mortgage harmony split up by appraised well worth in your home. An LTV off 80% is regarded as top by many people financial institutions. This means they will not let you hold financial obligation which is alot more than just 80% of one’s residence’s well worth. So it personal debt is sold with your home loan in addition to this new financing otherwise credit line.

Personal bank loan: That have a personal bank loan, you will be borrowing a particular lump sum payment of cash which is after that paid more a determined time, always anywhere between a couple and you can five years. Together with, the speed is restricted. Unsecured loans try unsecured (meaning your house is perhaps not utilized due to the fact equity whilst carry out feel that have an effective HELOC) and will be studied when it comes to mission the fresh borrower determines, in addition to merging debt otherwise since the cost of a big bills. Extremely, it is to the brand new debtor as to how they would like to use the mortgage.

Mastercard: A charge card, given from the a bank otherwise place, allows you to borrow money toward a running basis which have a good varying interest rate to cover services and products otherwise characteristics. Or even shell out your statement entirely per month, your own left balance deal more than. The kicker? Bank card attention may be greater as opposed which have an excellent HELOC otherwise personal loan.

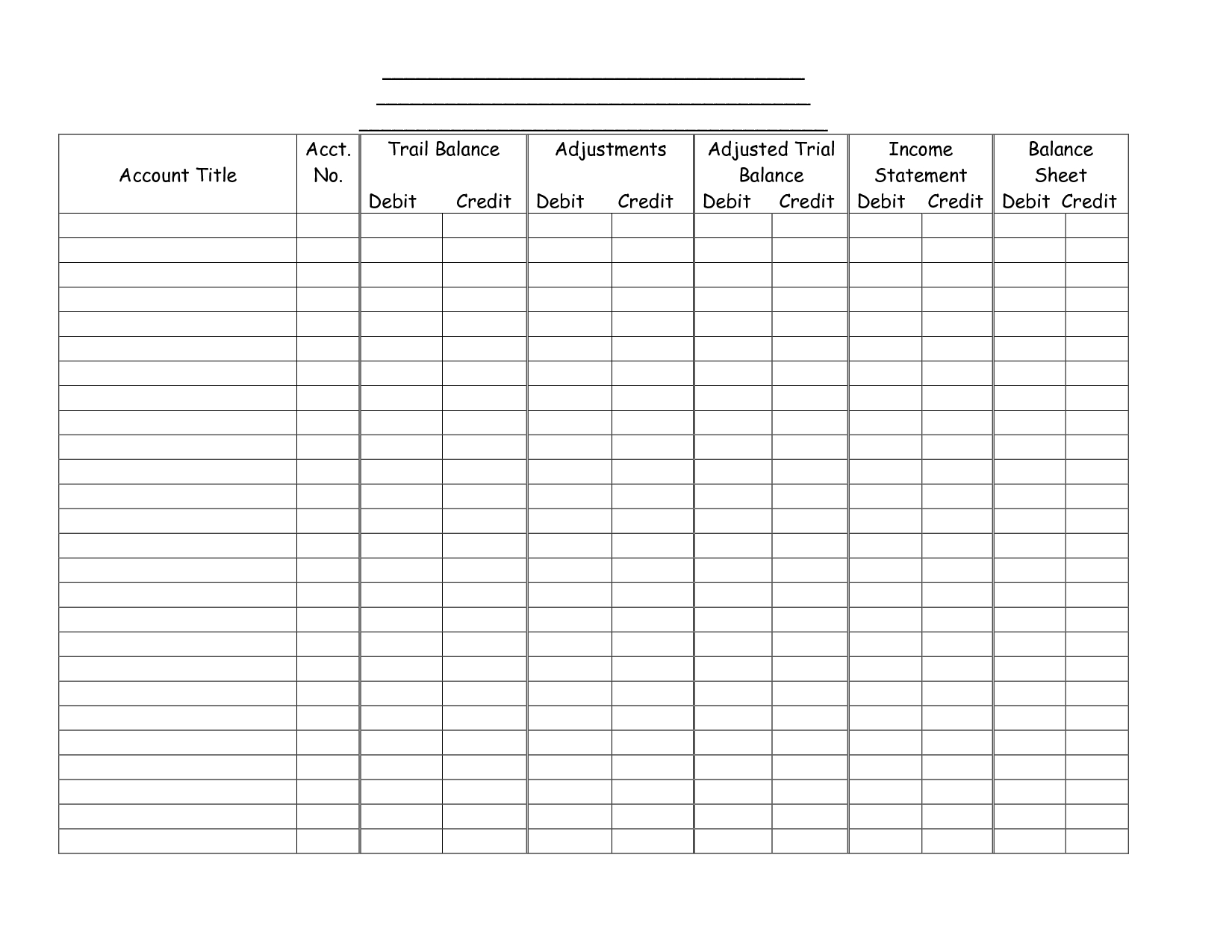

To break something down merely, let us evaluate unsecured loans, domestic equity lines of credit and you will credit cards with a graphic. This may assist you in deciding which choice is suitable for the lifestyle.