Highlights:

- Shortly after doubting their financial application, lenders was legitimately expected to render a created cause due to their decision for people who request you to.

- Preferred reasons home financing application is refused are low credit scores, movement on your income and you may a premier personal debt-to-income ratio.

- No matter what reason your application was refused, you can find things you can do to find straight back on way to homeownership.

If the mortgage application has been refuted, you may be not knowing out of just what measures when planning on taking 2nd. Luckily for us, home financing assertion has no to indicate same day loan Rico the conclusion into the hopes for homeownership.

Discover as to the reasons their mortgage application try declined

What is the the first thing you should do just after the mortgage application is denied? Grab several deep breaths – upcoming speak to your bank.

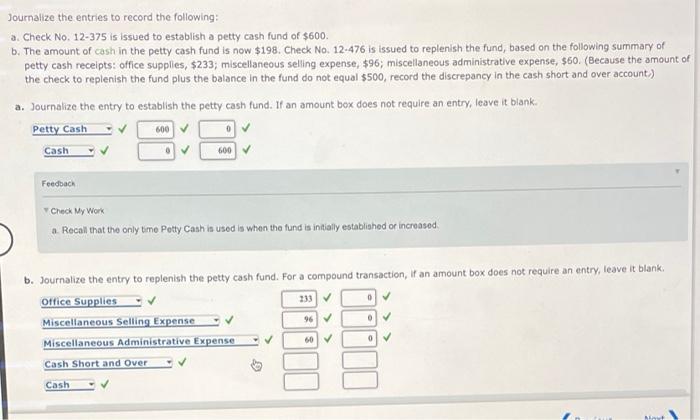

Immediately after rejecting your own mortgage software, lenders is legitimately necessary to bring a created explanation for their choice for people who ask for one. Labeled as a bad action letter, the explanation includes why you had been refuted credit, and that of the around three nationwide consumer reporting enterprises acquired your credit declaration and you will access to a totally free credit file to suit your remark.

With this article is critical if you hope to sign up for an alternate home loan down the road. Knowing why you was refused, you should understand the way to take effect on the monetary character and work out oneself a tempting debtor.

- Higher loans-to-money (DTI) ratio. Your DTI ratio, expressed as a percentage, ‘s the overall quantity of loans money you borrowed every month split up by the terrible month-to-month money. Inside the good lender’s eyes, the greater the DTI ratio, the much more likely you’ll be able to come across troubles and come up with home loan repayments. Extremely loan providers like a good DTI proportion up to forty% or reduced. So, if you’re currently carrying a more impressive range off obligations relative to your revenue, that will be a red flag for loan providers.

- High loan-to-well worth (LTV) proportion. The LTV ratio measures up how big the loan you may be hoping to track down for the appraised worth of the house you may be undertaking to acquire. It also considers any amount of cash you have reserved for your own advance payment. Generally, a lowered LTV ratio enables you to are available less risky so you’re able to loan providers. If the LTV ratio is too higher, meaning you happen to be requesting a mortgage that’s close to the value of your need assets, loan providers may refuse the new demand.

- Low credit scores. The home loan company spends your own fico scores as a whole foundation so you’re able to help influence your honesty as the a borrower. The low their credit scores are, the brand new reduced trust a loan provider does has on your power to pay off the loan.

- Motion within the money and you will transform to help you a career standing. Alterations in income could possibly get improve your DTI proportion and you can laws imbalance. Lenders generally favor financial applicants to have stored a great salaried, full-day standing on its team for two many years or more. If you have has just altered operate or keeps a history of carrying out thus, this may apply to their mortgage software.

- A boost in rates. If rates of interest increase inside the home loan app process, the loan alone can be more expensive. This may out of the blue push the loan from the monetary arrived at, particularly as opposed to a corresponding boost in your income.

6 ways to improve your potential to possess recognition

The good news is you to long lasting reasoning the job is actually rejected, you can find things to do to acquire right back to your path to homeownership. These types of strategies could help alter your creditworthiness and get ready your in order to reapply.

Pay-off personal debt. Of several mortgages is rejected because of a leading debt-to-income proportion. Therefore, paying off present financial obligation is just one of the ideal indicates your normally replace your chances of recognition. You could pay a great stability in your credit cards otherwise continuously go beyond the minimum fee on your personal otherwise figuratively speaking. Bring a careful look at your finances and then try to come across extra money where you are able to – the dollar helps.