Knowledge NRI Home loan EligibilityThe qualification requirements getting an enthusiastic NRI so you can secure a mortgage in the India try distinct however, straightforward:Age Limit: Applicants must be at the least 18 yrs old rather than meet or exceed sixty decades during mortgage readiness

For the majority non-citizen Indians (NRIs), home ownership into the Asia isn’t just an investment but a relationship to the root. Because of the powerful growth in India’s a house has seen an enthusiastic expanding quantity of NRIs committing to assets all over the country. Recognizing which development, Indian banks have tailored financial factors especially for NRIs, making the techniques significantly more available and streamlined than in the past. This article delves into requirements out-of protecting home financing in India as an enthusiastic NRI, of qualifications to the app processes, together with financial subtleties inside it.

A job Standing: NRIs have to have a reliable occupations abroad, which have the absolute minimum work months with respect to the lender’s rules.Income Balance: Money requirements will vary by the bank but generally need the candidate to own a constant earnings to help with mortgage costs.

Uses for Securing an enthusiastic NRI Domestic LoanNRIs meet the criteria to make use of having home loans for various intentions:House Pick: To acquire another otherwise resale house. Home Get: Getting a land having coming structure. Construction: Building a house towards the possessed homes.

Necessary DocumentationApplying for a mortgage requires NRIs to help you present multiple data files getting label verification, income facts, and you can possessions information:KYC Records: Passport, to another country target research, Indian address evidence (in the event the appropriate), Bowl credit, and you https://paydayloancolorado.net/coaldale/ will an image.Earnings Research: Previous income slips, to another country lender comments, and you may income tax returns.

Several Indian financial institutions are recognized for the NRI-friendly mortgage issues:State Lender out-of IndiaHDFC BankICICI BankAxis BankThese financial institutions not just promote competitive rates but also offer customer service in both Asia and you may major international countries, leading them to available to NRIs internationally.

Interest rates for the 2024Interest rates to have NRI home loans is competitive, which have banking institutions providing costs based on the applicant’s borrowing from the bank profile and you may the mortgage method of. As an instance:Kotak Mahindra Financial: Performing within 8.70% per annum County Financial regarding India: Regarding 8.60% per annum HDFC: Around 8.50% per annum

Tax Masters into NRI Family LoansNRIs is also get on their own regarding extreme tax positives with the lenders:Area 80C: Deduction as high as Rs. 1.5 lakh with the principal repayment annually.Part 24B: Deduction as high as Rs. dos lakh on notice commission a-year.These types of advantages can aid in reducing the entire taxable income out of an NRI, giving specific save considering the around the globe income tends to be susceptible to income tax within the India based on the home standing.

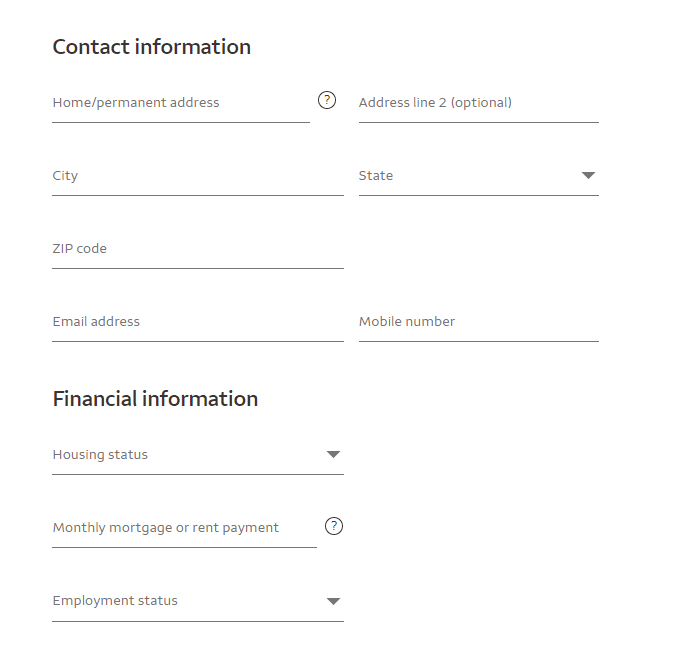

Software Procedure: Measures in order to FollowOnline Software: Look at the specialized web site of chose bank to fill in the program. Banking companies particularly HDFC and you will SBI bring dedicated portals for NRIs.Document Submission: Publish or courier the necessary data files because the given by lender.

Financing Sanction: Article verification, the mortgage is sanctioned

This process usually takes 2-3 weeks.Financing Disbursement: Up on contract finalizing and final property verification, the borrowed funds amount try paid.

What you should Keep an eye out ForExchange Speed Motion: Because loan money are generally manufactured in INR, alterations in exchange rates could affect the amount you find yourself spending.Judge Clearances: Guarantee the property has every expected courtroom clearances to quit coming conflicts.

ConclusionThe procedure of acquiring home financing in the Asia because the an NRI in the 2024 is smooth however, needs careful consideration of various issues plus selecting the most appropriate bank, knowing the income tax ramifications, and you will navigating from courtroom land off Indian a home. On proper preparation and you will knowledge, NRIs is also successfully secure a home loan to find the dream property during the India,so it is an invaluable financial support for future years.

Disclaimer: The newest viewpoints shown over are to possess informational intentions simply according to business reports and you can related development reports. Property Pistol cannot ensure the reliability, completeness, or accuracy of your information and you will should not be held accountable for step taken in line with the composed information.