At one time in the event that Va restricted the level of currency that will be loaned out on for every financing. Although not, you to definitely maximum try eliminated around 2019 toward Bluish Liquids Navy Vietnam Experts Operate.

Brand new Va Financial are often used to pick a preexisting single-house otherwise an alternate design family. When you need to buy another framework home, the fresh Virtual assistant builder Have to have a great Va Creator ID.

The fresh new Virtual assistant possess a list of condo plans which might be currently accepted for Va capital. You need to use their site to see if a condo your are thinking about is on its listing.

Whether your condo opportunity you are looking at isnt on the VA-recognized number, it could be nearly impossible in order to qualify for Va investment.

The house or property Need to Meet the Minimal Possessions Standards

The newest Virtual assistant wishes for every being qualified veteran to own a sufficient household to reside in when using the Va mortgage. Thus, per household that’s acknowledged to possess Va credit need certainly to ticket specific requirements.

These Va assistance handle all round shelter of the house to ensure that this new veteran will receive a gentle and you may sufficient domestic.

A lot of Virtual assistant property standards handle affairs such as since the electricity, plumbing system, and you will temperatures solutions and also the standing of one’s rooftop, base, and use of clean water.

Required Income For the Home loan Should be Consistent and you will Trustworthy

Some individuals try according to the incorrect idea that they will certainly you desire a premier-positions career with lots of many years on the job is approved toward Virtual assistant mortgage. It is not correct.

Send back again to the earlier part in the loans-to-income ratios plus the residual income rule. The fresh new underwriter look to make sure this type of guidelines try came across.

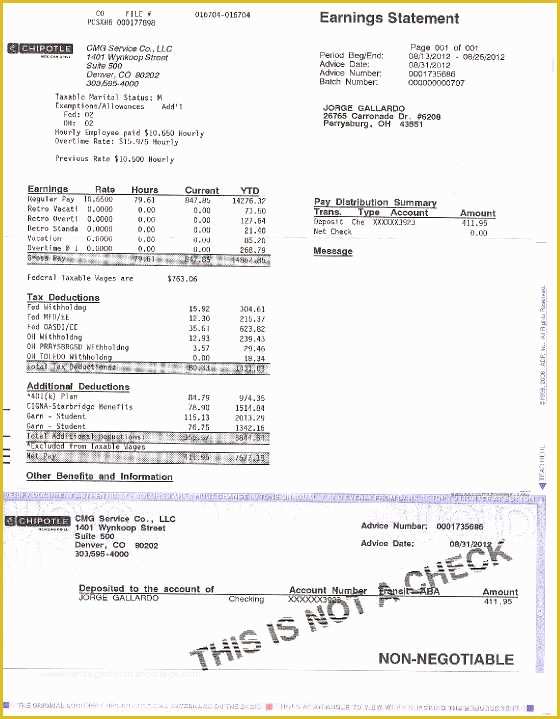

Next, the new underwriter look during the way to obtain the amount of money. Should it be one to full-go out job, or dos part-time services, or solution handicap along with a member-day business, it doesn’t matter. As long as you can also be document your revenue to possess the very least off 2 years and that the income has actually sometimes lived the new same or enhanced more that point, then you definitely would be fine.

In some situations, You’ll be able to Possess A couple Va Mortgages in one Day

/images/2019/10/11/petal-cash-back-visa-card.png)

Before we described that veteran need to propose to live-in our home since their head residence to qualify for this new Virtual assistant financial. Although not, there are, well-laid out factors in which an experienced may have a few e date.

That is called Virtual assistant Next-Tier entitlement. The most popular disease happens when a full-day services affiliate get a new Personal computers and ought to relocate. Info about this version of Va home loan can be available at the following hook up.

The new Va Even offers a streamlined Refinance Option If the Prices Go lower

New Va has actually a well-known alternative known as the interest reduction refinance mortgage, or IRRRL to own small. This will make it simple to re-finance with minimal paperwork significantly less than particular items.

Before applying into IRRRL, anyone must now have a beneficial Va financial to your a home that’s the primary residence. However they have to have a clean percentage installment loans in Missouri record into the financial for at least for the past 1 year.

The IRRRL is meant to assist people reduce steadily the rate of interest to their mortgage so that they has actually a lesser total percentage. Or, it will help people change from a variable-rate home loan so you’re able to a fixed-rates mortgage.

For folks who have started expenses to their mortgage to have ten years or even more, age but drop right down to an excellent 15-season repaired mortgage and you can conserve a lot for the interest across the remaining loan.